Understanding Head and Shoulders Peak or Pattern Correctly

Recently, trade and investment become a hot topic in the world. You may often find many people who encourage each other to trade because it will give them profit. However, before deciding to join the trading market, you must understand the property and trade phenomena. This will help you to decide on the next step because your actions will determine the risks or benefits lost. One of the terms that must be understood is the head and shoulder pattern. What’s that?

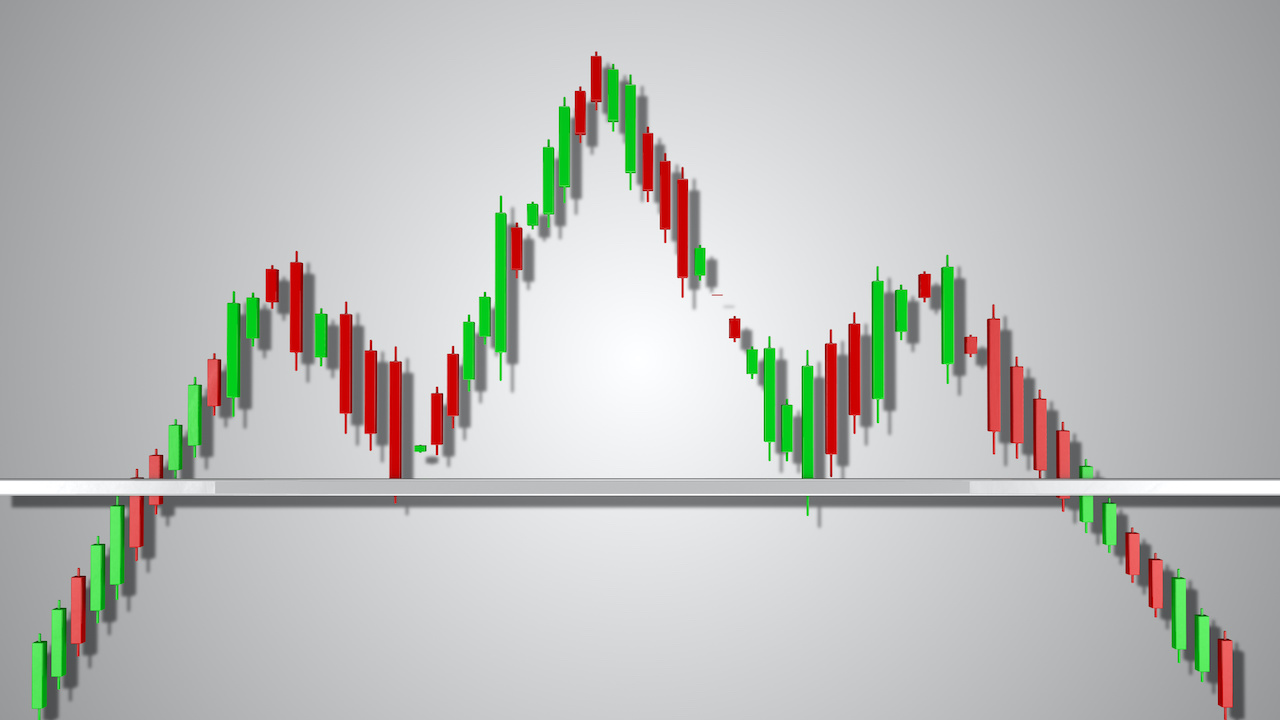

To understand what head and shoulder patterns, you can identify the shape of this pattern. There are three forms of this pattern. The first is the left shoulder. It was formed when the price rose. After that, it was followed by a decline. The second is the head made of price increases. It leads to the highest peak. That is why the peak is known as the peak of the head. The last is the right shoulder. It was made from the decline – and the price decline. However, the peak is lower than the top of the head. Well, this pattern also has a reverse version. This is called the head upside down and shoulders or head and shoulders.

Well, the trend in the formation of heads and shoulders in trade is caused by market actions. Previous bullish trends can cause fading momentum. This will cause the initial peak or left shoulder. Then, Bulls forced prices to increase again. This will lead to the top of the head because the bulls will dominate the market. After that, the male cattle will fall again. However, it will try to move up again which causes the right shoulder. However, after that, male cattle will fall and move to the ground. You can use this pattern to determine the high reversal probability.